Account Management

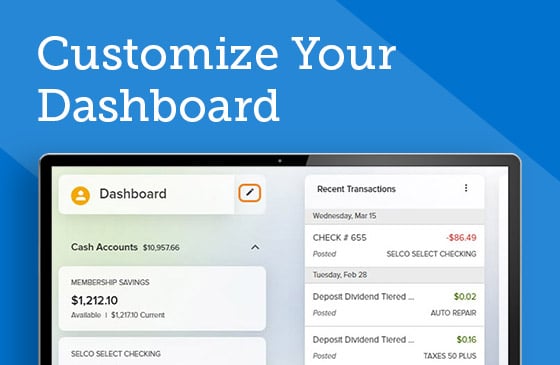

Customize Your Dashboard

Organize your digital banking dashboard however you’d like.

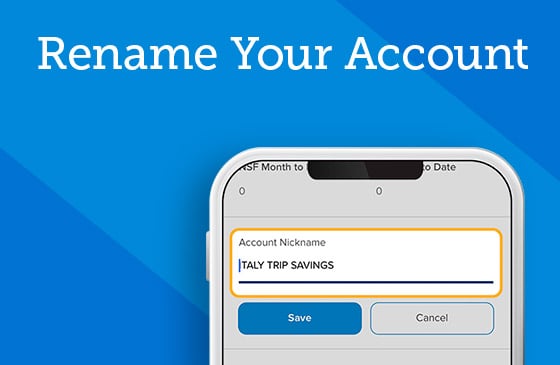

Rename Your Account

Make your accounts truly yours by giving them a name.

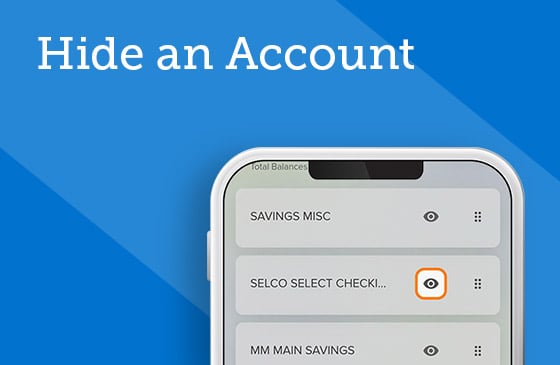

Hide an Account

Use the customize function to hide any of your accounts from viewing.

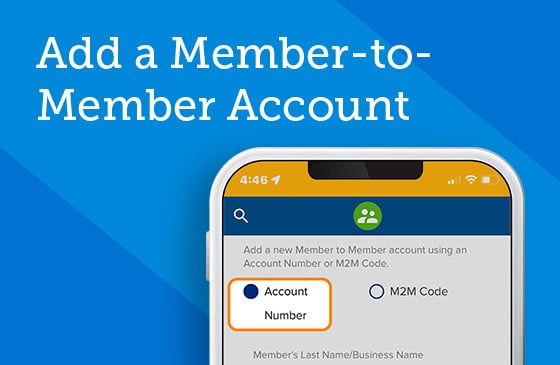

Add a Member-to-Member Account

Use a code or account number to set up the capability to transfer funds to other members.

View and Sort Recent Transactions

Easily access recent transactions from your digital banking dashboard.

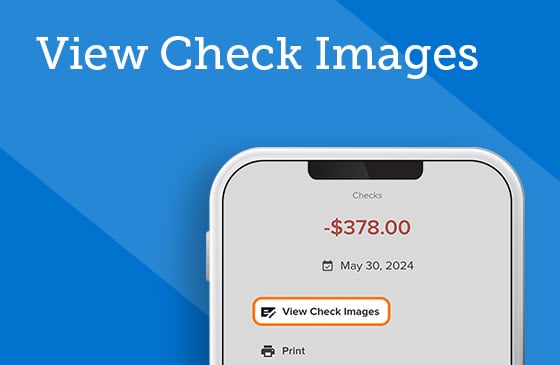

View Check Images

View and print images of the front and back of checks withdrawn from and deposited into your accounts.

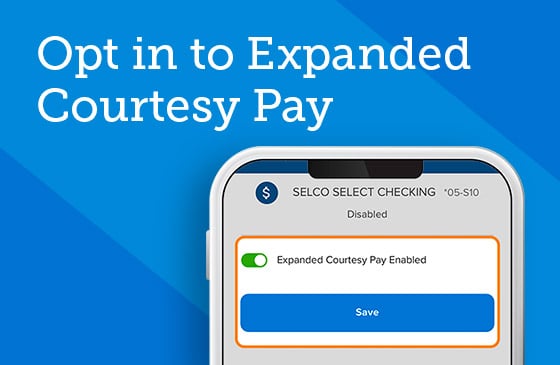

Opt in to Expanded Courtesy Pay

Add more overdraft protection on your checking account by opting in to this service.

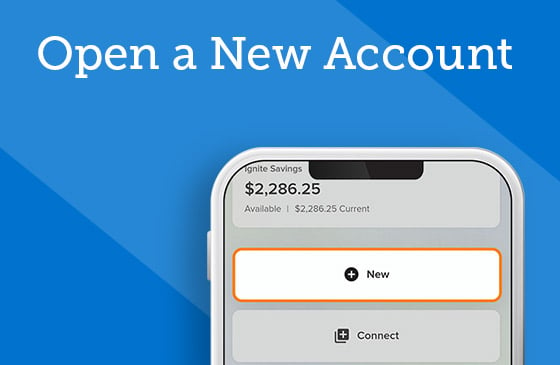

Open a New Account

Add a deposit account or two through this portal in digital banking.

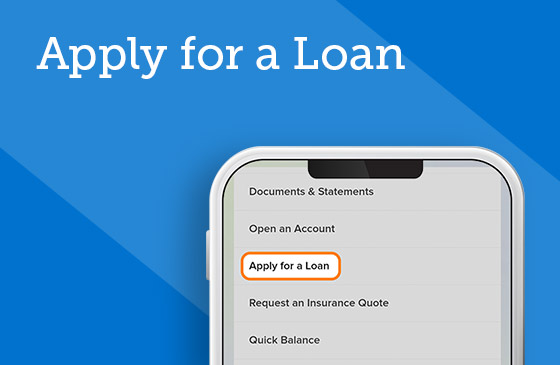

Apply for a Loan

Use digital banking as a portal to an easy-to-navigate tool for applying for SELCO loans.

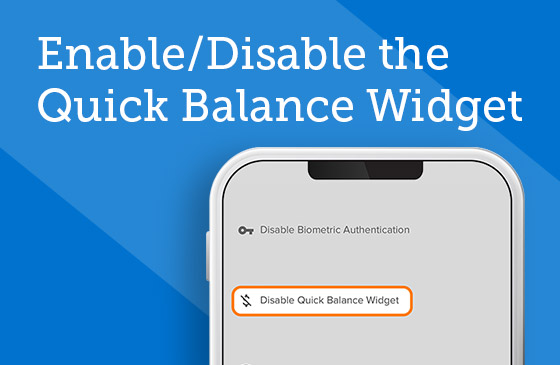

Enable/Disable the Quick Balance Widget

Quick Balance lets you see your account balances without logging in.

Send a Secure Message

Safely contact SELCO’s Service Center directly in digital banking.

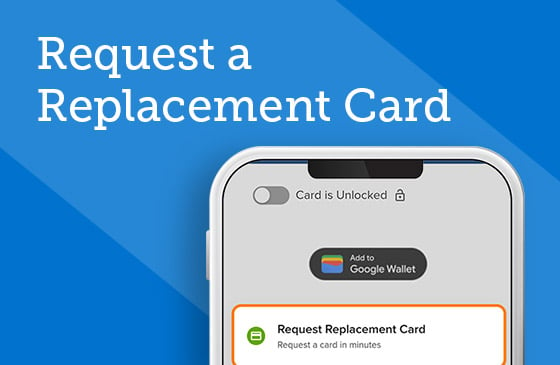

Request a Replacement Card

Place an order for a new debit or credit card with just a few taps on your device.

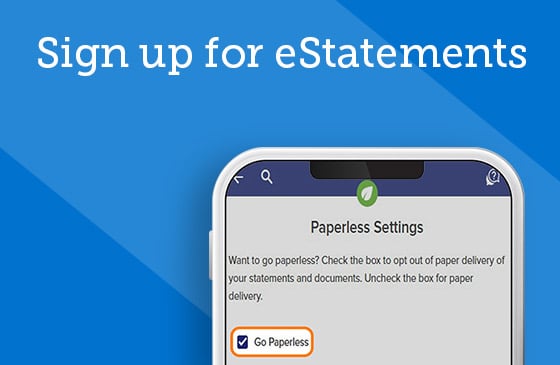

Sign up for eStatements

Ready to go paperless? It’s easy to sign up for and view your statements in digital banking.

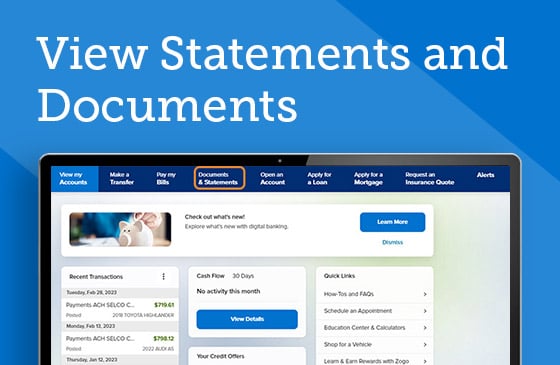

View Statements and Documents

Go paperless for digital access to your monthly statements and other documents.

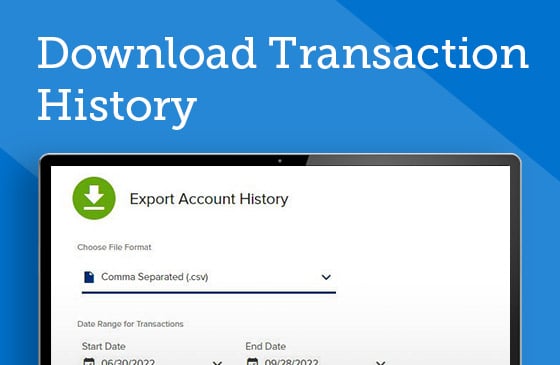

Download Transaction History

Export your account history (and print it) to review and keep on file.

Update My Contact Info

Save a phone call or email by updating your contact information in digital banking.

Create and View Account Reports

Get a snapshot of all your transaction history over a specified time in a few easy steps.

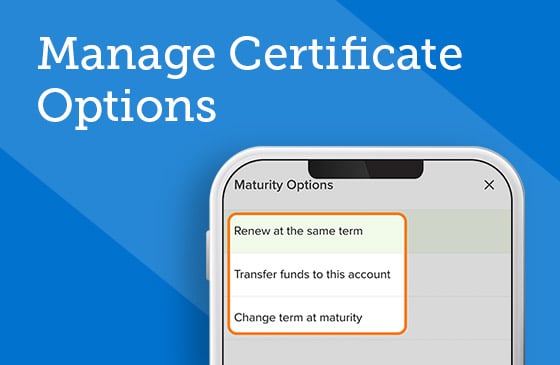

Manage Certificate Options

Set your preferences for your balance at maturity and how dividends are disbursed.

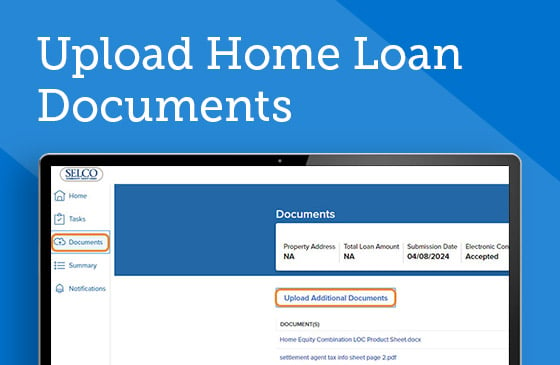

Upload Home Loan Documents

Quickly upload necessary mortgage loan documents through our secure portal.

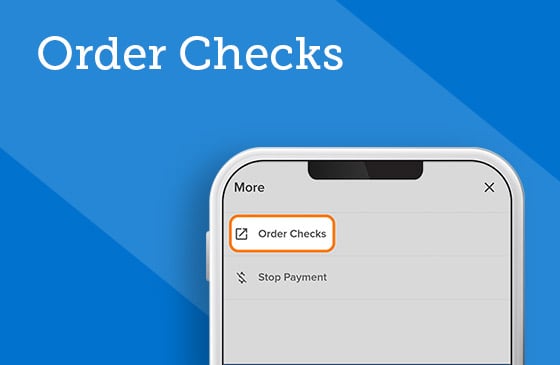

Order Checks

Order or reorder personal checks or business checks in a few easy steps.

View & Update Insurance Information

Ensure your insurance is sufficient to protect your loan collateral against physical damage.

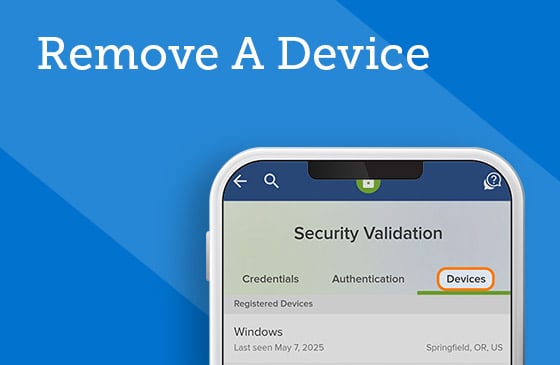

Remove A Device

Safely remove a phone, tablet, or desktop computer from digital banking.

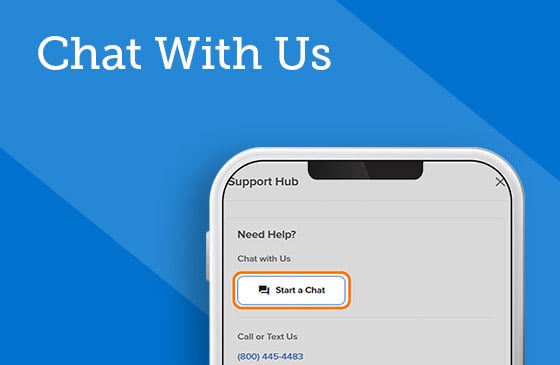

Chat With Us

Initiate a secure chat with a SELCO representative or our virtual assistant, Liv.