Credit Cards

SELCO Platinum Visa® Card

- Lower rates than most rewards and store cards.

- No annual or balance transfer fees.

- Visa Zero Liability®, meaning you're protected from fraudulent activity.

- Check your balance and pay your bill through digital banking.

- Give yourself peace of mind while lessening the financial strain on your family by adding Payment Protection.

Visa Card for Teen Accounts

- A safe way to start building credit and learn financial responsibility.

- Vault account holders can apply at any SELCO branch. (You’ll need a qualified co-borrower.)

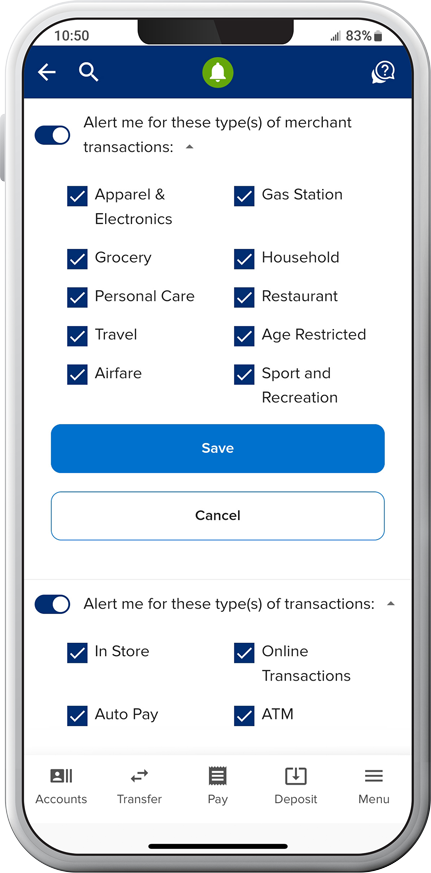

SELCO’s card controls have your back

Take complete control of your cards within digital banking.

- Add your card to a mobile wallet.

- Turn your card off when you’re not using it.

- Set transaction alerts by amount or purchase type.

- Add travel notices in just a few clicks.

Resources

Make Debt Work for You

It might seem like “credit” and “debt” are used interchangeably, but they actually refer to two distinct things. Simply put, credit exists before you make a purchase. Debt appears after.

Signs You Might Be Living Beyond Your Means

It's easy to accrue debt these days. Steer away from the "living paycheck to paycheck" path by checking yourself for these red flags.

Looking to Consolidate Debt? Try a HELOC.

Burdened by high-interest credit cards? A home equity line of credit can be a great way to consolidate debt and minimize monthly payments.

Protect Yourself From Financial Burden

Payment protection offers a simple way to ensure your loans don’t become a hardship if you’re gone. Learn the differences between Payment Protection and life insurance.