Card Management

Fraud protection at your fingertips

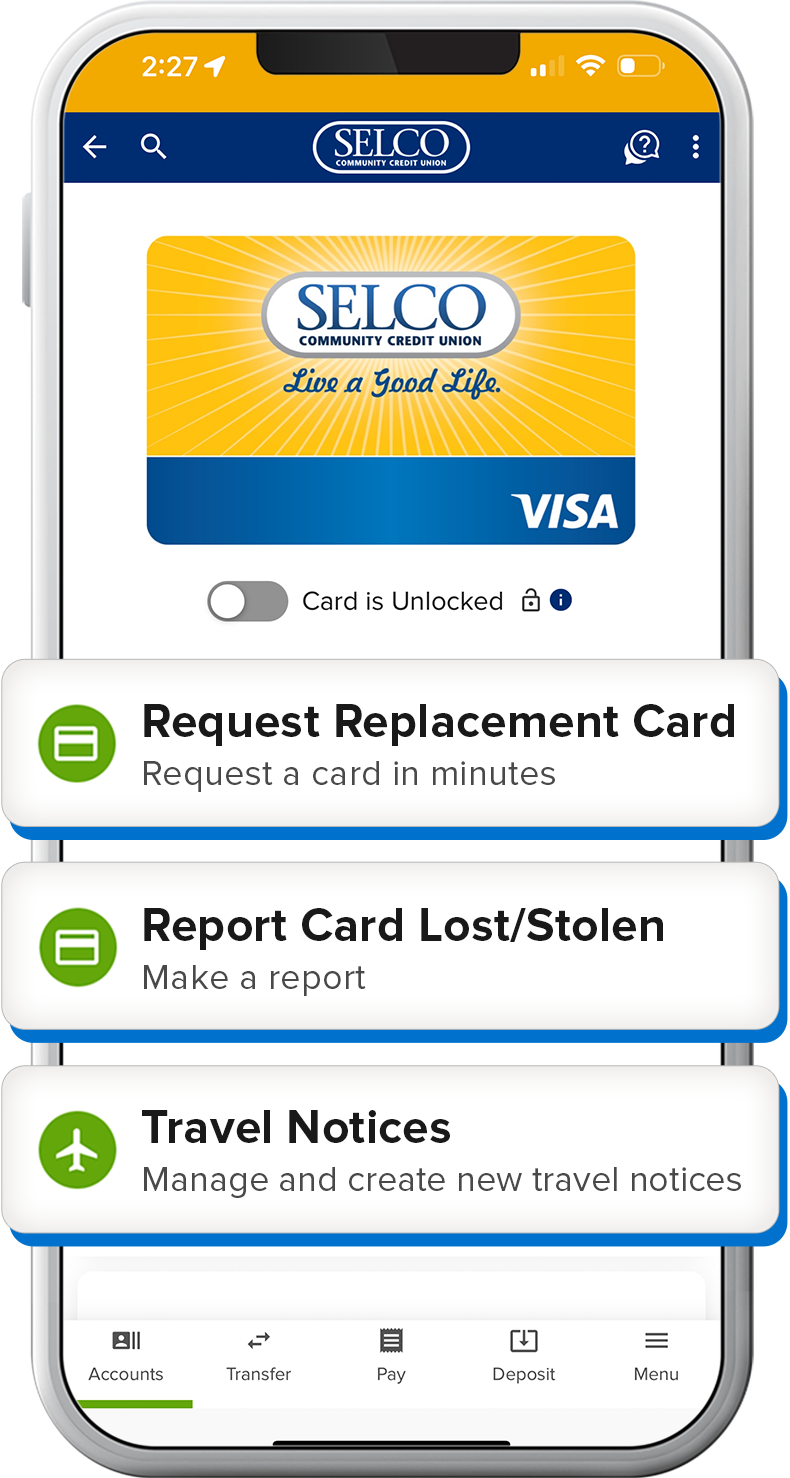

Manage cards

Lock your card when you’re not using it, request a new card, or report a card lost/stolen.

Set travel notices

Add travel notices for various destinations. Once your travel notice is added, you’re all set.

Track transactions

Set transaction alerts by amount or automatically decline certain transaction types.

Create account alerts

Monitor your balances, logins, and more, with account alerts.

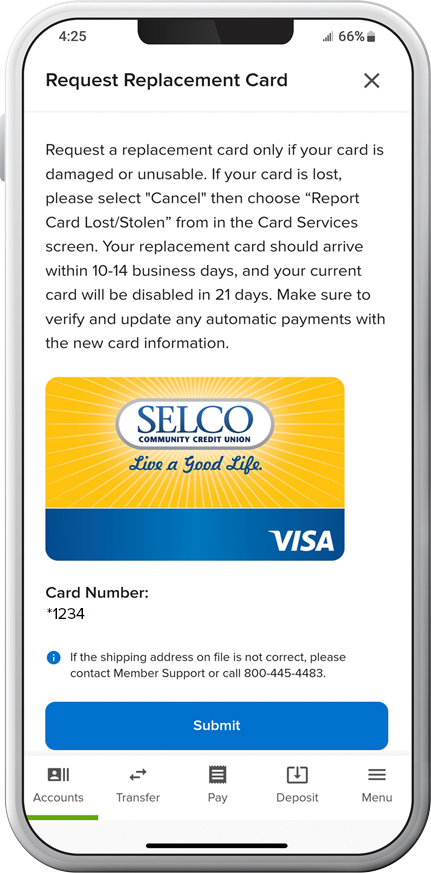

Need a replacement card?

If your debit card has been misplaced or stolen, or if it’s simply seen better days, you can order a replacement in just a few clicks. Your replacement card should arrive within 10–14 business days.

Report card lost or stolen

Select “Report Card Lost/Stolen” and we'll immediately disable your card and get a new one on its way.

Order a replacement card

Click or tap “Request New Card,” select the card you’d like replaced, then hit “Submit.”

Resources

7 Visa Card Features That Might Surprise You

A SELCO Platinum Visa credit card is more than just a piece of plastic used for buying things. Dig deep enough, and you'll find several benefits and perks that you may not have been aware of.

P2P Payment Systems: What You Need To Know

Peer-to-peer (P2P) payment systems are changing the way we handle our money. It’s now easier than ever to pay back friends and family.

Be Aware of Free Trial Offers

Before taking advantage of free offers, make sure you know what you’re signing up for, what resources are at your disposal, and what steps to take to keep surprises from appearing on your statements.

Make Debt Work for You

It might seem like “credit” and “debt” are used interchangeably, but they actually refer to two distinct things. Simply put, credit exists before you make a purchase. Debt appears after.