Phone Banking Transition Guide

Digital banking: Secure, anytime account access

With a single secure login to digital banking on a desktop computer or the SELCO app, you can:

- Check your account balances

- View transaction history

- Report debit/credit cards lost or stolen

- And so much more.

Once You're Enrolled, You Can ...

Enable/Disable the Quick Balance Widget

Quick Balance lets you see your account balances without logging in.

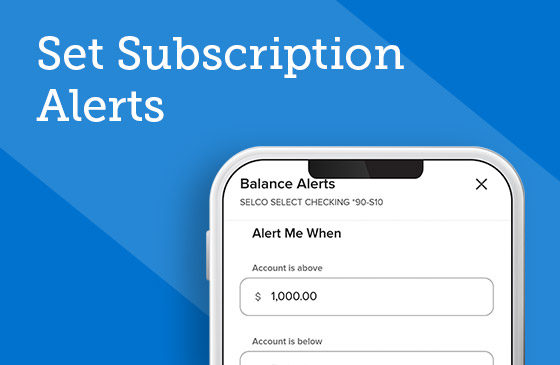

Set Subscription Alerts

Receive alerts when balances are low, checks clear, loans are coming due, and more.

View and Sort Recent Transactions

Easily access recent transactions from your digital banking dashboard.

Transfer Between Accounts

Set and forget recurring transfers or quickly move money between your accounts.

Report Card Lost/Stolen

Cancel your misplaced or stolen card and order a replacement within seconds.

Request a Replacement Card

Place an order for a new debit or credit card with just a few taps on your device.

Transfer to Another Institution

Schedule one-time and recurring transfers to your non-SELCO accounts.

Initiate a Same-Day External Transfer

Move money between institutions quickly by choosing a standard same-day transfer.