How-Tos and FAQs

Your one-stop shop for tutorials, tips, and FAQs for making the most of your SELCO accounts.

Search Resources

Search Resources

Business Resources

Explore how-tos and FAQs related to business banking topics.

Featured How-To Resources

Register for Digital Banking

Sign up as an individual or business in a handful of easy steps.

Add Usernames to Login Dropdown

Seamlessly go back and forth between your account logins from a single dropdown.

Find Your Routing & Account Info

Quickly locate SELCO’s routing number and your account information.

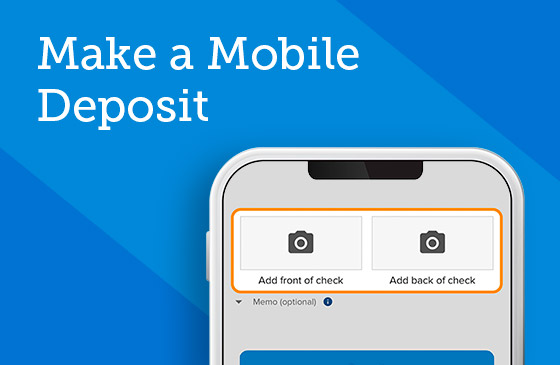

Make a Mobile Deposit

In just a few steps, deposit checks into one of your deposit accounts using your device’s camera.

Enable/Disable the Quick Balance Widget

Quick Balance lets you see your account balances without logging in.

Send a Wire

What you’ll need to know to wire money within and outside the US.

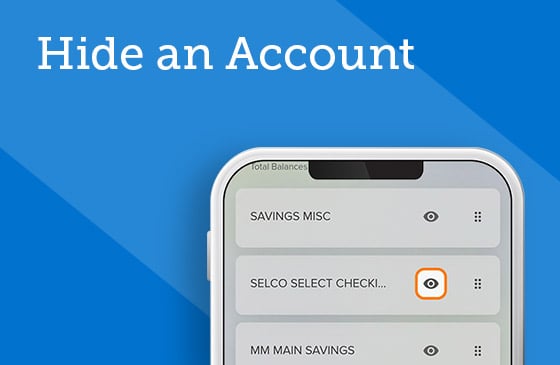

Hide an Account

Use the customize function to hide any of your accounts from viewing.

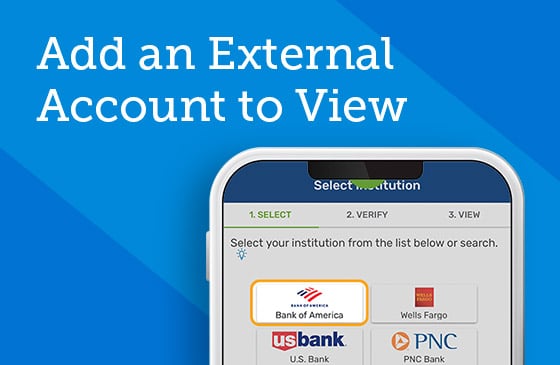

Add an External Account to View

Set up external institutions that you’d like to view from your digital banking homepage.