Thinking about applying for a loan? You’ll want to pay close attention to your credit score.

But what is a credit score? And why does it matter?

But what is a credit score? And why does it matter?

In short, your credit score demonstrates to lenders how likely you are to pay back a loan. The higher the score, the better you look to a lender, which often means better rates and terms on a loan. Read on to learn what a credit score is, how to improve it, and how to keep it high.

What is a credit score?

Your credit score is a three-digit number—generally ranging from 300 to 850—based on the information in your credit report. The following score ranges determine your borrowing power:

| FICO Score Ranges | Rating | Description |

| 580 | Poor | Well below the average score of US consumers. Demonstrates that you’re a risky borrower. |

| 580-669 | Fair | Below the average score of US consumers, though many lenders will approve loans. |

| 670-739 | Good | Near or slightly above the average score of US consumers. Most lenders consider this a good score. |

| 740-799 | Very Good | Above the average of US consumers. Demonstrates that you are a dependable borrower. |

| 800+ | Exceptional | Well above the average score of US consumers. Clearly demonstrates that you are an exceptional borrower. |

What factors influence your score?

A credit score is calculated using data grouped into five categories in your credit report. The three big nationwide credit monitoring services—Equifax, TransUnion, and Experian—all weigh each category a little differently, so your score may vary slightly among them. Here’s a breakdown of each category with tips on making the most of them.

| Category | Description | How to Give Your Credit Score a Boost |

| Payment history | Have you paid your bills on time? | How promptly you pay bills has the strongest influence on your score. |

| Amounts owed | Where do your balances sit in relation to your credit limits? | Try to keep your balances under 30% of the credit limit on each of your revolving accounts. |

| Credit Age | How long has it been since you applied for your first credit card? | The longer your credit history—and maintaining a timely payment history for a mix of accounts—the better. |

| Mix of Credit | Do you have experience with several types of credit (mortgage, student loans, credit cards, etc.)? | While it’s good to have a mix, you don’t want to eventually owe too much money. Keep paying down your outstanding loans. |

| Recent Credit | How many credit accounts have you opened recently? | Apply for credit only when you need it. If you open too many accounts too frequently, you’re considered a high-risk borrower to lenders. |

Become more credit score-savvy in digital banking

SELCO’s digital banking platform has a slick new tool called SavvyMoney Credit Score. This resource is designed purely to help members learn how to manage their credit score (not to determine credit worthiness when applying for a SELCO loan). You can access it anytime without your credit getting “pinged” or “dinged”—since it’s a “soft inquiry,” your score won’t be impacted.

SELCO’s digital banking platform has a slick new tool called SavvyMoney Credit Score. This resource is designed purely to help members learn how to manage their credit score (not to determine credit worthiness when applying for a SELCO loan). You can access it anytime without your credit getting “pinged” or “dinged”—since it’s a “soft inquiry,” your score won’t be impacted.

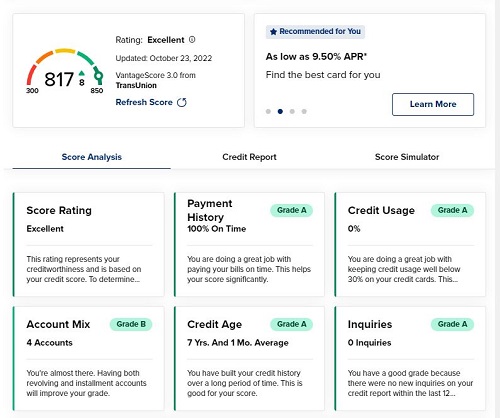

Here’s a quick look at what SavvyMoney has to offer:

- Your current credit score (updated every seven days) and most recent credit report.

- Detailed analysis of your payment history, credit usage, credit age, account mix, and inquiries.

- Alerts if significant changes (opening new accounts, inquiries made, change in employment) may affect your credit score.

- A Score Simulator tool that predicts what could happen to your credit score if certain actions are taken, like applying for new credit and making on-time payments.

- FAQs and other resources to help you improve your score and optimize your financial health.

Now that you’re well-versed in credit scores, all that’s left is to go out and get that score as high as possible. For more information about SELCO’s credit score tool, check out this How-To and FAQ. You can also give “The Ins and Outs of Credit” a read for a deeper dive into how credit works.