Phishing alert: SELCO impersonators are using texts and calls to request balances, login credentials, and card numbers. As a reminder, SELCO will never contact you requesting sensitive information, including login credentials. If you receive one of these messages, please delete it or hang up immediately.

Payments & Transfers

Frequently Asked Questions

SELCO limits electronic transfers made via digital banking from certain savings accounts to six per calendar month. Because of this, you cannot make more than six monthly electronic transfers from each savings account, secondary savings account, or money market account.

Digital banking operates in real time, so transactions are reflected on your account immediately.

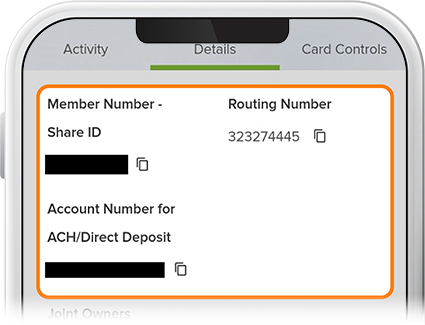

Your savings/checking/loan ID is a two-digit number at the end of your member number. A common savings ID is 01 and a common checking ID is 10. However, if you have multiple savings, checking, or loan accounts, you’ll also have multiple IDs.

To locate a specific two-digit ID, log in to digital banking, then click or tap your checking, savings, or loan account. Your account ID will be located in the Details section under "Member Number - Share ID."

Note: You’ll also notice a letter before each ID; when requesting a transaction, please include only the numbers.

If you want to transfer money to another SELCO member, please contact the member directly for the correct ID number.

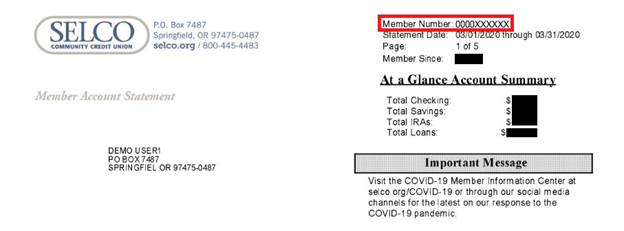

Your member number (ranging from 3-7 digits, zeroes not included) can be found in digital banking within any of your accounts. Check out this How-To for instructions on locating your member number, routing number, and full account number for direct deposit purposes—all in one place.

Your member number is also located in the upper right of your monthly eStatement or paper statement.

If you can't locate your member number, feel free to call us at 800-445-4483 and we'll help you look it up.

If you receive this message, it's likely because you don't currently have an email address on file. Once you add your email, you shouldn't see this message again.

To add your email: Log in to digital banking and select your profile icon in the upper-right corner, then select “Profile” (on mobile, select “Profile” from the Menu option). Under the Personal Details tab, enter your email address, then select “Save Changes.” You should now be ready to enroll in Bill Pay.

This is expected and based on what that payee has requested the Bill Pay processor use. If there are any updates to your payee information, these changes will happen automatically and will help ensure that your payments are processed quickly and correctly.

If you need to update contact info for an electronic payee—including individual payees—you’ll need to delete and re-add the payee.

Credits from external accounts will typically post in 1–2 business days. This brief delay helps ensure the credit isn’t returned to the originating institution due to an error or insufficient funds.

- In digital banking: External transfers initiated by 9:00am PT on a business day will arrive the same day. Transfers initiated after 9:00am PT will arrive the next business day.

- By phone or in person: External transfers scheduled by 2:00pm PT will arrive the next business day.

Eligible account types are personal savings, checking, and loans. Please note: Eligibility to add loan accounts is typically determined by the external institution.

Yes, though you must submit your transfer before 11:00am PST on a business day. Otherwise, your transfer will be processed within 1-2 business days.

Yes! Consumer loans may be paid directly using an external transfer. While business loans are currently unable to be paid with an external transfer, members can transfer to a deposit account and then to the business loan.

You sure can. And it can all be done from the Card Services tab inside your credit card account. Check out the “Make a Credit Card Payment” How-To for step-by-step instructions.

There is no fee for a cash advance on a SELCO Platinum Visa®. However, interest begins accruing on the day of the transaction. This is different than making a purchase with your credit card, which allows for a 25-day grace period before interest begins accruing.

You’ll have 15 business days to verify your external account. After that time, the trial deposits we sent will no longer be valid, and you’ll need to start the process again.

Statements are updated once a month (at month’s end). For this reason, payments made before the statements are generated will not be reflected until the following month’s statement has been posted.

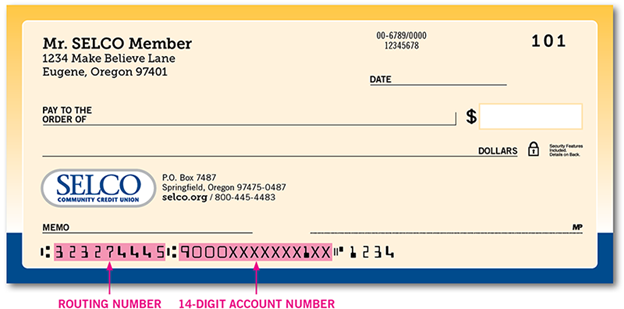

You'll need your routing and account numbers to set up direct deposit or an electronic tax refund. The routing number is the 9-digit number found in the lower left of your checks, in digital banking, and at the bottom of every selco.org page. SELCO's routing number is 323274445, which is the same for every SELCO member. Your 14-digit account number is located in the lower middle of checks, and also can be found in digital banking. Each account has a unique 14-digit account number.

In digital banking, select any of your accounts and click or tap Details. Your member number/share ID, routing number, and full account number for ACH/direct deposits will be listed at the top. Your full account number, listed under the "Account Number for ACH/Direct Deposit" heading, will be the one you'll use when setting up direct deposit or making ACH transfers.

You can also find the routing number at the bottom of every selco.org page. Also, remember that each account has a unique 14-digit account number.

With the upgrade, account holders can each have their own personalized login. Each account holder will also have their own Bill Pay profile and payees, meaning scheduled bill payments won’t immediately be visible between users. However, account owners can submit a secure form in digital banking to request Bill Pay profiles be manually linked between users.

SELCO allows up to two skip payments over a rolling 12-month period on eligible loans with the following conditions. A $30 fee applies.

- No other conditions of the original loan agreement will be modified.

- A minimum of three consecutive payments must be made between Skip Payments.

- All SELCO accounts must be in good standing.

Please note, not all loans are eligible. The following loans are excluded:

- Loans with Collateral Protection Insurance (CPI) added.

- Past due loans.

- Real estate secured loans.

- Auto loans in the Options program.

- Loans with payment arrangements or payment deferrals agreed to with the Collections Department.

Note: Interest on a loan balance will still accrue when a payment is skipped.

To get started, check out our Request a Skip Payment How-To.

A wire transfer is a secure method of electronic funds transferred from one person or entity to another, either domestically or internationally.

Wires are guaranteed funds upon deposit, so it is difficult to reclaim funds once they have been sent. For this reason, scammers often request payment through a wire transfer since they are usually irreversible, so it’s important to know who the funds are being sent to and why.

You can initiate a wire transfer quickly, and the recipient typically has access to the funds upon deposit. Wire transfers also allow you to safely transfer money all around the world.

You can initiate a wire transfer right in digital banking—our Send a Wire How-To will walk you through each step. You can also visit any branch or call us at 800-445-4483.

Outgoing wire transfer requests received Monday–Friday before 2:00pm PST will generally be processed the same day. International US dollar wires requested after 2:00pm PST will be processed the next business day. Foreign exchange wires require more time to process due to exchange rates. All wires may be subject to a callback and may not be sent until we are able to verify the transaction with you over the phone.

SELCO does not receive a notification when a wire transfer has been received by the beneficiary account holder. Typically, domestic wires can take up to two business days to be received and foreign wires may take up to 14 calendar days.

Every wire transfer initiated from a SELCO account will list an availability date by which the funds should be received. If that date has passed and the beneficiary has not received the funds, please reach out to SELCO so that we can do further research.

Please call us at 800-445-4483, send us a secure message through digital banking, or visit a branch so we can send a correction.

The limit for transferring within digital banking depends on how the funds are being transferred (internal transfer, external transfer, or with Bill Pay) and your account service level. The best course of action would be to attempt the transfer within digital banking. If you're unable to complete the transfer, please call us at 800-445-4483. Learn more about payments and transfers here.