Raise your hand if this sounds familiar.

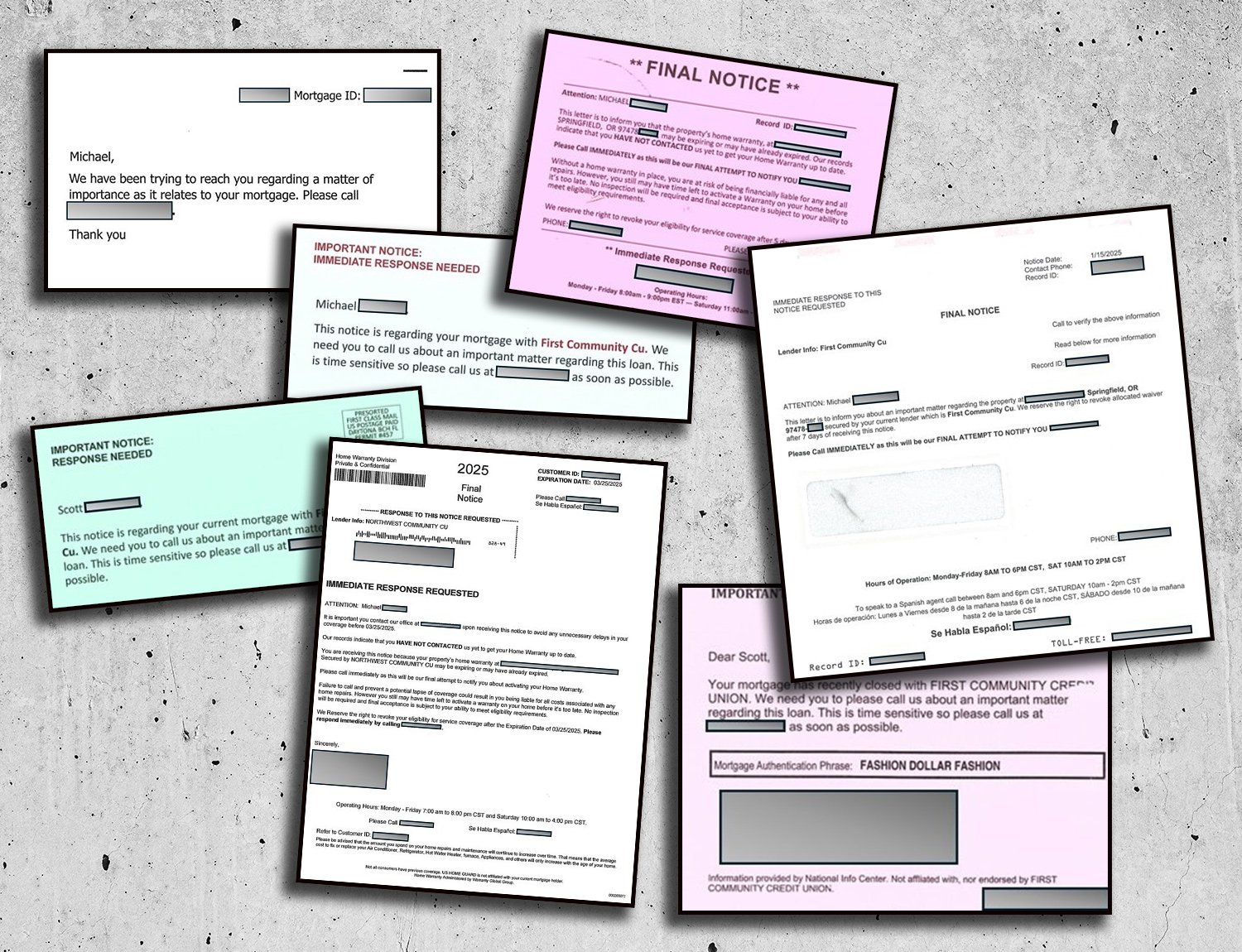

You get the keys to your new home. There’s a stack of junk mail at your new house addressed to “Current Resident”—advertisements for home remodeling, pest control, lawn care services, etc. Then, before you can even settle on a living room layout, you start getting a different type of junk mail. Offers for mortgage protection insurance (MPI) or to obtain copies of your deed information for a fee. Advertisements for a lower rate and payment. Sometimes, it can even look like your lender sent the mail.

Where does this unsolicited mail come from? How did they get your information? (Important note: SELCO will never sell your personal information.) And is there any way to stop it?

Where does this unsolicited mail come from? How did they get your information? (Important note: SELCO will never sell your personal information.) And is there any way to stop it?

Once your loan closes, information like your name, address, lender, and loan amount are recorded with the county and become public records. These records are important, as they keep track of all interests in the property and are needed to safely buy and sell real estate. Otherwise, it would be open season for scammers. But it also means that marketers can bombard you with unwelcome (and often confusing) offers.

Before you decide to toss everything into the recycling bin, however, read on to learn how to spot these third-party offers and what you can do about them.

Is the mail from your lender?

There are certain tells that show the mail is not from your lender:

- Slight spelling or grammar errors. (See “SELCO CMNTY CU” in the image at left.)

- Urgency in the message. If it’s an advertisement or spam, you’ll notice “salesy” phrases like “call now” or “immediate response needed.”

- Limited or generic information. Vague messages like “Call us about an important matter” or “There is an issue with your loan” are sure signs that your financial institution isn’t involved.

- Disclaimer in tiny print. Ads often include a disclaimer near the bottom of the page or postcard that says something to the effect of “information from public records” or “not affiliated with (lender).”

“There are a lot of common (and harmless) offers sent through the mail after you close on a home,” said Mike Lavender, Director of SELCO Mortgage. “But sometimes we see insurance offers that list our full name, loan number, etc., in an attempt to trick people into thinking they have a connection to SELCO.”

Ways to stop (or at least slow down) the influx of junk

There’s really no stopping junk mail from arriving in your mailbox or inbox. But you can trim the volume significantly by visiting sites like these:

- OptOutPreScreen.com. Opt out of offers for credit or insurance, free of charge.

- CatalogChoice.org. This not-for-profit organization offers opt-out service for several types of junk mail. Also free.

- PaperKarma.com. An app-based subscription service for Android and iOS devices, PaperKarma has more than 100,000 mailers in its database that you can block.

While junk mail of this sort can be annoying, make sure you scan it before recycling and/or blocking it all. Your mortgage lender will still send legitimate information occasionally, especially if you opted out of receiving paperless statements.

Above all else, it’s important that you never send money or share personal information when you receive unsolicited mail. If you’re unsure about the legitimacy of your mail, contact your mortgage lender. SELCO’s experienced Mortgage team is always on hand to answer your questions.