My Account

Frequently Asked Questions

Your savings/checking/loan ID is a two-digit number at the end of your member number. A common savings ID is 01 and a common checking ID is 10. However, if you have multiple savings, checking, or loan accounts, you’ll also have multiple IDs.

To locate a specific two-digit ID, log in to digital banking, then click or tap your checking, savings, or loan account. Your account ID will be located in the Details section under "Member Number - Share ID."

Note: You’ll also notice a letter before each ID; when requesting a transaction, please include only the numbers.

If you want to transfer money to another SELCO member, please contact the member directly for the correct ID number.

Your member number (ranging from 3-7 digits, zeroes not included) can be found in digital banking within any of your accounts. Check out this How-To for instructions on locating your member number, routing number, and full account number for direct deposit purposes—all in one place.

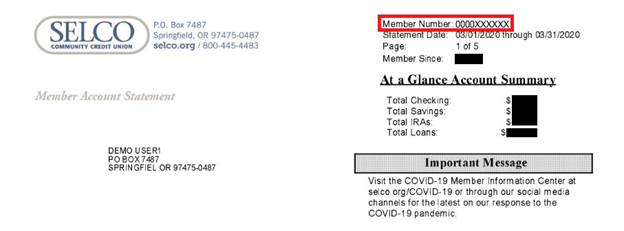

Your member number is also located in the upper right of your monthly eStatement or paper statement.

If you can't locate your member number, feel free to call us at 800-445-4483 and we'll help you look it up.

Our policy is to make deposits available to you on the same business day they are received. In some cases, we may hold some or all funds deposited by check to ensure there are enough funds in the check issuer’s account. If we need to place a check hold of any kind, we’ll notify you when you make your deposit. (See also the “Funds Availability Policy” in the Membership and Account Agreement.)

Yes, joint owners can access the account in the same way that you do. To gain access, joint owners will be required to register for digital banking independently using the primary account holder’s account information, then create their own username and password. (Check out this how-to.)

You may be locked out. As a security feature, if you unsuccessfully attempt to log on to digital banking 3 times, access will be denied for your account. This is to prevent someone from trying to guess your password. If you are having difficulty logging on, please call the Service Center at 800-445-4483 during business hours or click on the "Forgot your username or password?" link at the digital banking login screen to unlock your account.

You can reset your password by clicking on the "Forgot your username or password?" link on the digital banking login page. Or you can call the Service Center at 800-445-4483 during business hours so that we may reset your password.

Please send us a secure message or call the Service Center at 800-445-4483 during business hours. To send a secure message, click on the envelope in the upper-right corner.

An overdraft occurs when your available balance is not enough to cover a transaction but SELCO authorizes and pays for it anyway.

We use your available balance to determine whether there are sufficient funds in your account to cover any transactions. Your available balance is your actual balance minus:

- Holds placed on deposits.

- Holds on debit card or other transactions that have been authorized but are not yet posted.

- Any other holds, such as holds related to pledges of account funds and minimum balance requirements or to comply with court orders.

Your actual balance reflects all deposits and posted payment transactions. We don’t use your actual balance to determine whether your account contains sufficient funds since it doesn’t reflect checks you’ve written that are still outstanding or transactions that have been authorized but are still pending.

SELCO’s Standard Courtesy Pay service comes with your checking account and covers overdrafts from checks and other transactions made with your checking account as well as recurring transactions scheduled for payment with your SELCO debit card.

SELCO’s Expanded Courtesy Pay covers overdrafts from ATMs and one-time SELCO debit card transactions. Expanded Courtesy Pay service is available only if you qualify and opt in.

Courtesy Pay does come with some restrictions. It is a discretionary service, and we reserve the right not to pay your overdraft. For example, we typically do not pay overdrafts if your account is not in good standing, if you are not making regular deposits, or if you have too many previous overdrafts. Your Courtesy Pay balance must be paid in full as soon as possible. Each Courtesy Pay transaction will be assessed a $25 fee.* Fees are subject to change. Please consult SELCO’s Rate & Fee Schedule for details.

*Different types of checking accounts may have different fees. For example, SELCO Elevate checking accounts charge a monthly fee instead of a “per occurrence” fee.

As a security feature, if you unsuccessfully log in three times, your account will be restricted from online access. (This is to prevent someone from trying to guess your password.) To unlock your account, click the “Forgot Password” link and follow the instructions. You can also contact us through live chat or by calling 800-445-4483 and we’ll help reset your password.

You'll only receive a 1098 form if you paid more than $600 in interest on a mortgage or home equity loan. If you do not receive a 1098 but need a document showing interest paid, your year-end statement will fulfill that purpose.

You'll only receive a 1099-INT form if your total dividends earned for the year was $10.00 or more (accounts that have earned less than $10.00 are not reported). You can verify your year-to-date (YTD) dividends information on your December statement. (A YTD summary will be listed for each interest-earning deposit account.)

If you earned over $10.00 in dividends for the year and did not receive a 1099-INT, please contact us.

The NCUA stands for the National Credit Union Administration, an independent federal agency that regulates credit unions and insures their members’ deposits. (Banks have a similar agency called the FDIC.) Your SELCO accounts are guaranteed by the NCUA’s Share Insurance Fund up to $250,000 per person. No American has ever lost a single penny on their insured accounts at any federally insured credit union in the US. As a federally insured credit union, there’s really no better place for your money.

You can estimate your specific account coverage using the NCUA’s Share Insurance Estimator.

Another item that came up was including the share insurance estimator on the site. I’m really not sure how best to present that? I suspect this would be more of an internal resource vs external. Here’s the link to the calculator: https://mycreditunion.gov/insurance-estimator

our SELCO accounts are guaranteed by the National Credit Union Share Insurance Fund up to $250,000 per person. No American has ever lost a single penny on their insured accounts at any federally insured credit union in the US. As a federally insured credit union, there’s really no better place for your money.

You can estimate your specific account coverage using the NCUA’s Share Insurance Estimator.

Depending on the type of SELCO card you have, and the account level you're at, there may be a limit on your purchases and ATM transactions. Some ATMs also have limits on the amount you can withdraw, so you may need more than one transaction. To learn more about your withdrawal limit, call us at 800-445-4483.

There are several factors that could impact your ability to use an ATM. For example, exceeding your daily transaction amount, lack of available funds, or the card isn’t activated, may be expired, or is restricted for suspicious activity. Please call us at 800-445-4483 and a representative will be happy to review your account.