The art of the scam has been around for centuries, and the “uniqueness” scam is no exception.

It goes by many names, but the goal is always the same: to prey on a victim’s desire to feel special or exclusive. Scammers do this by exploiting emotional vulnerabilities and tendencies to chase exclusive or limited-time offers. Classic examples include:

It goes by many names, but the goal is always the same: to prey on a victim’s desire to feel special or exclusive. Scammers do this by exploiting emotional vulnerabilities and tendencies to chase exclusive or limited-time offers. Classic examples include:

- Romance scams, which target people looking for an emotional connection.

- Investment schemes, which promise high returns with little or no risk.

- eCommerce scams, in which fake online stores are created to mimic legitimate businesses.

eCommerce scams have become especially rampant. A recent study by Juniper Research, an industry leader in financial technology insights, shows that losses from eCommerce fraud are expected to rise from $44.3 billion in 2024 to $107 billion by 2029. Uniqueness scams (often with the aid of artificial intelligence) are set to play a big part in that.

Characteristics of eCommerce uniqueness scams

A large-scale ring of fake eCommerce websites published in multiple languages is a big reason why eCommerce fraud has skyrocketed. Over the past 10 years, the criminal enterprise behind this ring has lured unwitting consumers to more than 75,000 fake but realistic-looking websites featuring unrealistically cheap prices and limited-time discounts.

Here’s how the scammers hook their victims:

- Developers create fake online shops offering discounted designer goods. To add an air of legitimacy, they frequently take over expired web domains from previous online stores and copy legitimate stores’ product catalogues.

- Using a number of social engineering techniques, scammers advertise these screaming deals across social media and online marketplaces. This is often done by impersonating legitimate businesses—the price of the merchandise might be comparable to the real site and may not appear to be fake initially—or creating fake social media profiles.

- Once a purchase is made, there are often delivery issues or the item turns out to be counterfeit, defective, or doesn’t even exist—or, worse, scammers steal consumers’ credit card information to make fraudulent transactions or attempt to take over accounts.

How to identify fake shopping websites

Fortunately, there are ways to detect illegitimate online shops. Here are some of the main culprits:

- Ridiculously low prices. When you think of bargain-basement deals, Amazon Prime Day, Black Friday, and Cyber Monday come to mind. When a website you’ve never heard of advertises prices that are a small fraction of what they normally are, it’s most likely a scam.

- Spelling and grammar errors. While many fraudulent websites have become more sophisticated thanks to the proliferation of AI, many still are riddled with grammatical errors.

- Lack of contact information. A legitimate online store will normally have multiple ways to contact them—physical address, phone number, and email address. Look for a well-developed “About Us” page and customer support options.

- No return/refund policies. Even when ordering from a legitimate shopping site, there’s always a chance you’ll want to return the merchandise or get refunded. If a site fails to offer a clear return and refund policy, chances are it’s not real.

- Poor customer service/bad reputation. There’s no shortage of consumer opinions on the internet. If an online store is under water in negative reviews, walk away.

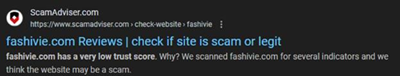

“To research the merchant, Google the website address with the word “scam” at the end to determine if it is safe or trustworthy,” said Samantha Miller, Senior Card Services Specialist at SELCO. “The Better Business Bureau reviews and complaints for that merchant are a great way to determine if other customers received their orders or have reported issues.”

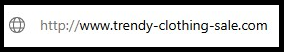

- Unsecured or manipulated addresses. If a website doesn’t contain “https” in the address or a padlock icon in the address bar, it’s not secured. Fake sites also often use web domains that resemble legitimate sites but will add subtle misspellings or additional words, like “sale” or “discount.”

“It’s important to be vigilant when making purchases online that appear too good to be true,” Miller said. “Avoid clicking on all advertisements on social media or sponsored websites that appear at the beginning of search engines as you could be directed to a fraudulent website that mimics a legitimate business.”

Staying an additional step ahead

Follow these guidelines to help protect you and those you care about:

- Use security software. Your PC or device’s operating system should already be protected by reliable antivirus and anti-phishing software. If it isn’t, here are the current top-rated software packages.

- Browse safely. By developing healthy browsing habits—setting strong passwords, enabling multi-factor authentication, and steering away from suspicious links or pop-up ads—you’ll be protecting your sensitive data.

- Monitor your finances. Regularly check your accounts for suspicious activity. SELCO’s Digital Banking features several security and account alerts to help you keep a watchful eye on your account activity.

Visit our Security Center for more tips and tools to help you keep scammers at bay.

Uniqueness scams are on the rise. If you find a deal of a lifetime online, take the guidelines above to heart, and you’ll likely discover the bargain is too good to be true. Be proactive and get these suspicious websites on the Federal Trade Commission’s radar. And if you think you’ve fallen victim to a scam or fraud, contact your financial institution and/or credit card company right away.