Security Center

Featured Article

Understanding Card Skimming and How to Prevent It

Card skimming is an evolving scam that can be difficult to spot. Fortunately, evolving security features and preventative measures by consumers can stop it from happening.

Identifying fraud and recognizing red flags

URLs

Unsecured websites (missing the “https” or padlock symbol) and obscure URLs should give you pause.

Reviews & Ratings

Search for reviews and testimonials about the site or business, and check ratings on trusted sites like the Better Business Bureau (BBB).

Unrealistic Promises

Beware of offers that seem too good to be true, including promises of discounts much lower than market prices.

Emails, Calls, or Texts

Be extra diligent when unexpected emails, calls, or texts come your way. Always verify the source independently before responding.

FCC's List of Current Scams

The Federal Communications Commission's consumer guide is another great resource for the latest and trending frauds, scams, and alerts.

Steps you can take as a SELCO member to protect your accounts

Turn on Card Controls

Turn your cards off and on instantly, set controls and alerts by amount or transaction type, and add travel notices to prevent declines when you’re away from home.

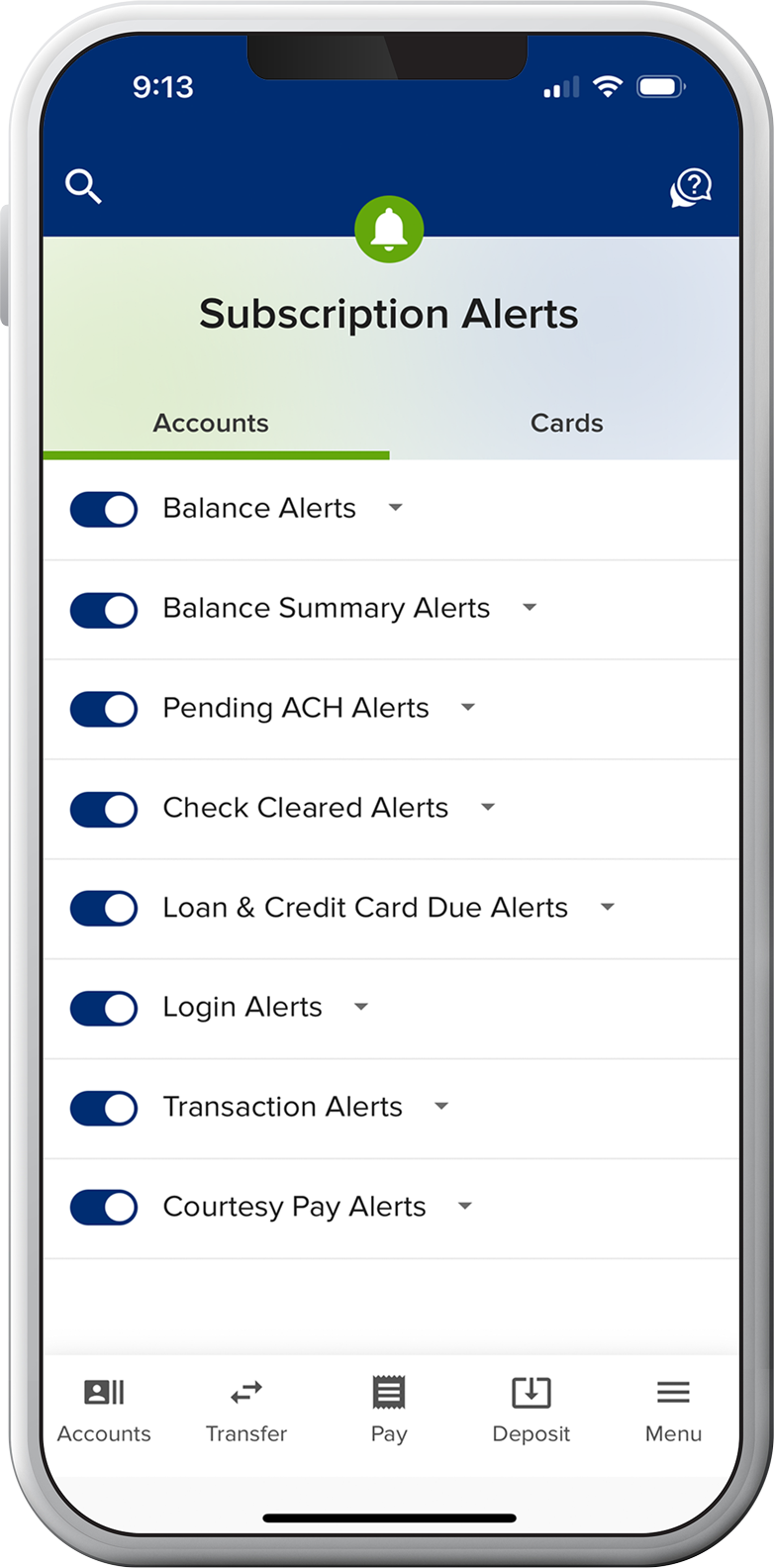

Set Transaction Alerts

Receive email or text alerts when checks clear, loans are coming due, suspicious activity occurs on your account, and more.

Allow Voice Authentication (Voice ID)

Voice ID makes it much quicker to verify you when you call. And by analyzing thousands of voice characteristics to create a unique voiceprint, it’s nearly impossible for fraudsters to bypass, even with advanced AI techniques like deepfakes.

Enable Fingerprint/Face ID and Push Authentication

Log in to digital banking quickly, securely, and uniquely. You can also opt in to push authentication to boost your security while verifying yourself with the tap of a button (SELCO mobile app required). Or, switch from receiving text/phone security codes to using an authenticator app of your choice. Push notifications are more secure than receiving security codes.

Common Scams

Romance, Family & Friend Scams

These scams usually start online and occur when a new love interest or distant relative spends time getting to know you, developing trust before making:

- Requests for money or a loan.

- Requests for travel, medical, or emergency expenses.

- Promises of a fortune.

Holiday & Hardship Scams

Bad actors use the holidays to take advantage of people’s generosity, often targeting those who are older and more financially established. These scams may include:

- Requests for donations to familiar-sounding charities.

- Requests for gift cards or gift card numbers.

- Online retailers with too-good-to-be-true deals.

Employment & Investment Scams

For those entering or re-entering the workforce, finding a job can be daunting. Scammers are aware of this and will use it to tout “opportunities of a lifetime.” Keep an eye out for:

- Requests to open—and share access to—financial accounts.

- Unrealistic guarantees of approval for a position or loan.

- Requests for sensitive personal information.

- Offers to make investments on your behalf

Phishing/Smishing Scams

Online systems have never been more secure, with multiple ways to protect your information, so scammers are finding new ways to access this sensitive information through:

- Fraudulent links and codes that entice you to reveal personal information.

- Pop-ups posing as legitimate security software warnings.

- Data breaches that reveal sensitive information.