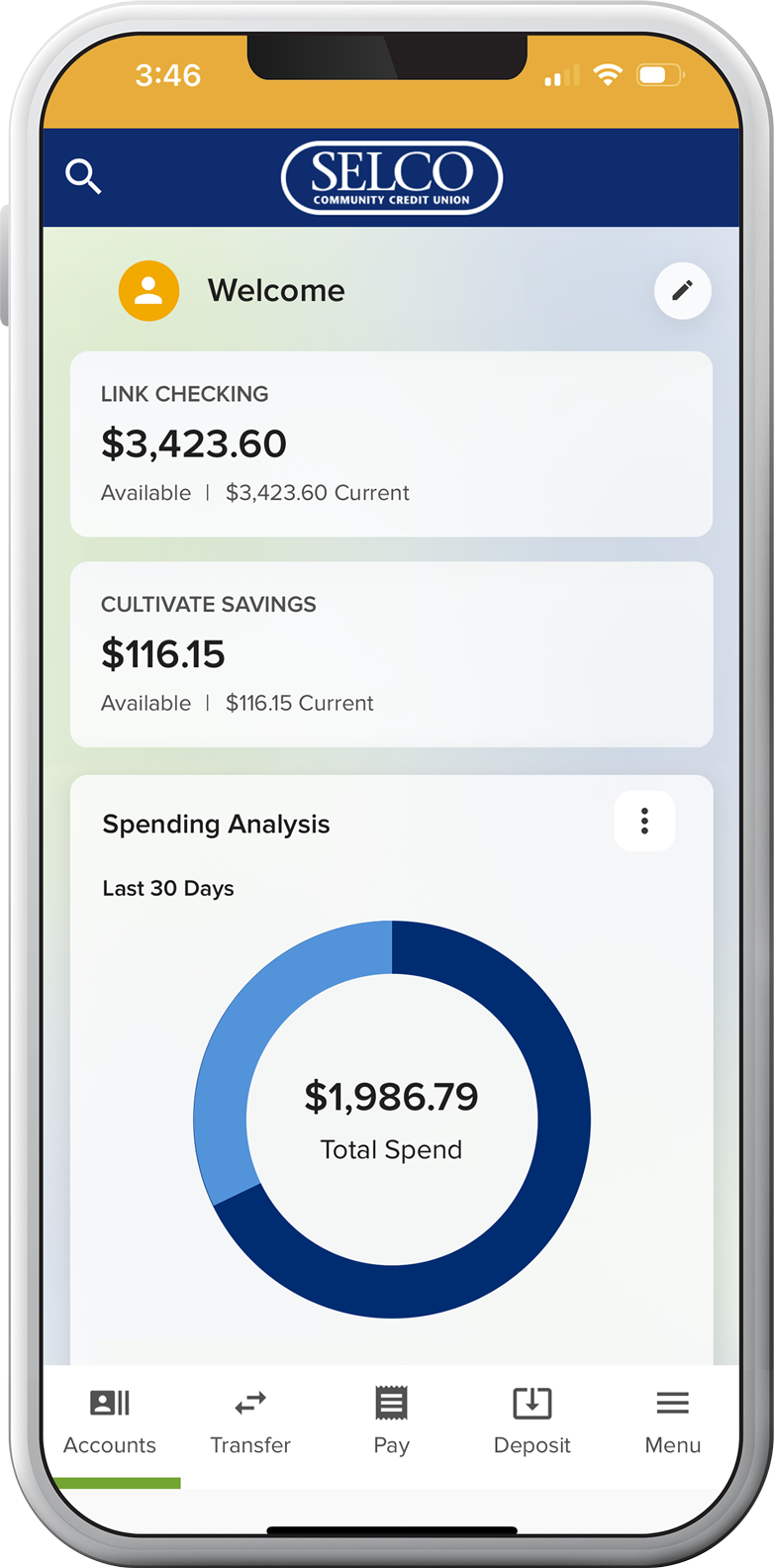

Spending and Account Management

Track your spending and goals

Set saving goals

Create multiple spending goals, transfer funds automatically, and visualize your progress.

Analyze your spending

Monitor your spending, get personalized recommendations, and forecast how much money you’ll have in the future.

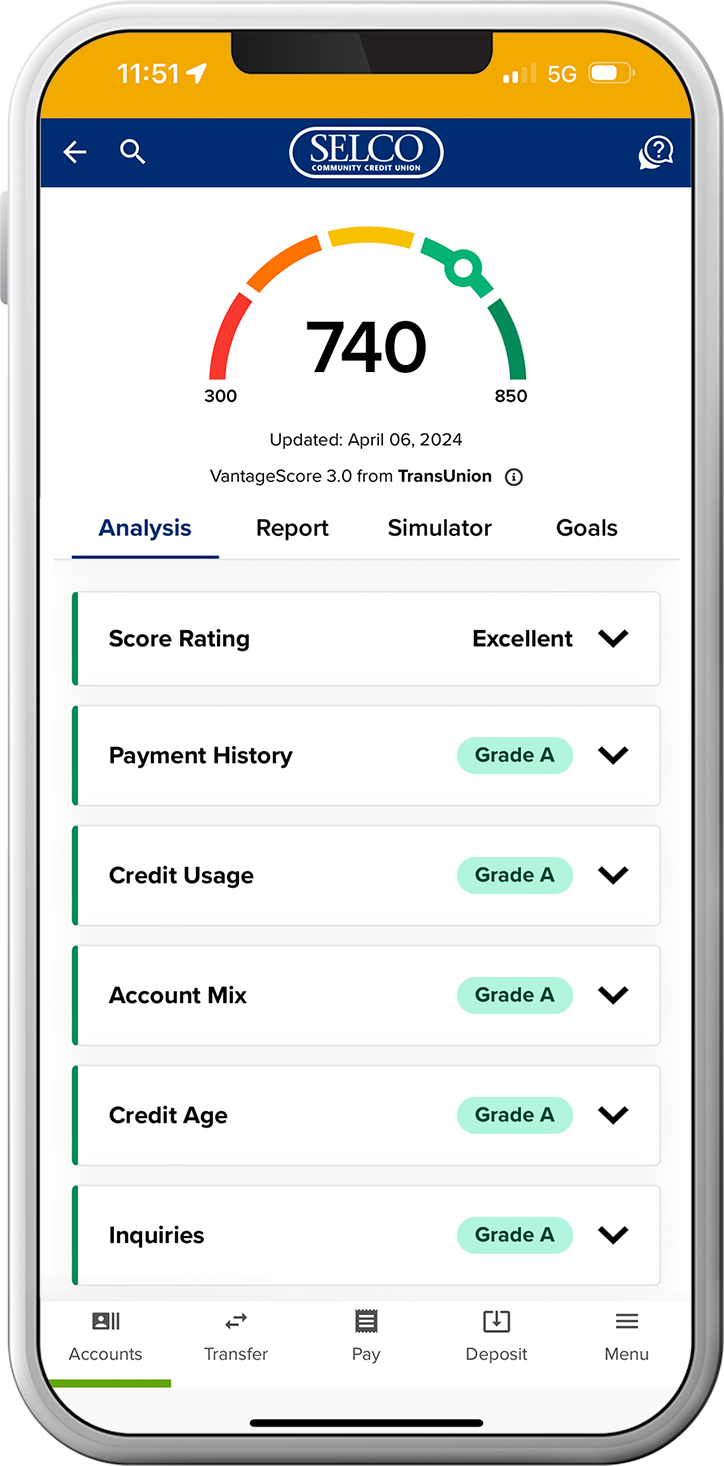

Monitor credit score

Keep tabs of your credit score in real time, anytime, for free.

Categorize transactions

Organize transactions by customizing transaction names and categories.

Get your financial health check up

Digital banking assesses your spending, debt, credit score, planning behaviors, and savings to offers personalized recommendations. Financial resources are available from your digital banking dashboard and integrated with your account history.

Free credit monitoring

See your credit score in real time, view recent inquiries, review payment history, track credit usage, and so much more. Plus, you’ll get personalized feedback on ways to boost your score.

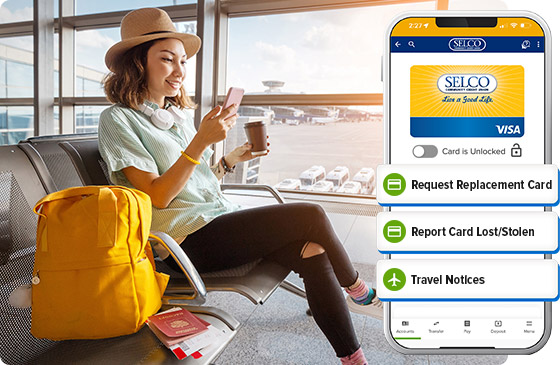

Fight fraud with card controls

Secure your cards from potential fraud with these integrated controls:

- Turn your cards off and on instantly.

- Set controls and alerts by amount or transaction type.

- Add travel notices to prevent declines when you’re away from home.

Resources

Make Debt Work for You

It might seem like “credit” and “debt” are used interchangeably, but they actually refer to two distinct things. Simply put, credit exists before you make a purchase. Debt appears after.

What To Know About ‘Buy Now, Pay Later’

Choosing a "Buy Now, Pay Later" option at check-out is so easy, it almost seems too good to be true. Learn the pros and cons of using these services.

Organizing Your Household Finances

Whether it’s in a bulky metal filing cabinet or secure folders on your computer, an organizing system for your financials can make all the difference.

Start Saving Now for Your Child’s Education

College tuition has tripled over the past 30 years. All the more reason to take advantage of savings tools (like 529 College Savings Plans) early.